Legal Case APPOINTMENTS

We are temporarily pausing legal research services. Any requests submitted through the form will be answered after the end of the UC Berkeley spring semester.

We are open weekdays 10am-5pm for virtual and in-person appointments at our Eshleman Hall office. Walk-ins are available on a first come first-serve basis, or you can make an appointment through the Google Form linked below.

Please fill out the form below if you would like to make an appointment to discuss your legal questions or concerns with caseworkers in the ASUC Student Legal Clinic. Once this form has been submitted, your case will be assigned to two of our caseworkers, and you will receive a confirmation email with the date, time, and Zoom link (if virtual) for your first meeting. We can only serve clients who reside in California. The Clinic has proudly served the Berkeley community for over 30 years, providing free and confidential legal research catered to the issues our clients are facing.

Legal Case Google Form

We are open weekdays 10am-5pm for virtual and in-person appointments at our Eshleman Hall office. Walk-ins are available on a first come first-serve basis, or you can make an appointment through the Google Form linked below.

Please fill out the form below if you would like to make an appointment to discuss your legal questions or concerns with caseworkers in the ASUC Student Legal Clinic. Once this form has been submitted, your case will be assigned to two of our caseworkers, and you will receive a confirmation email with the date, time, and Zoom link (if virtual) for your first meeting. We can only serve clients who reside in California. The Clinic has proudly served the Berkeley community for over 30 years, providing free and confidential legal research catered to the issues our clients are facing.

Legal Case Google Form

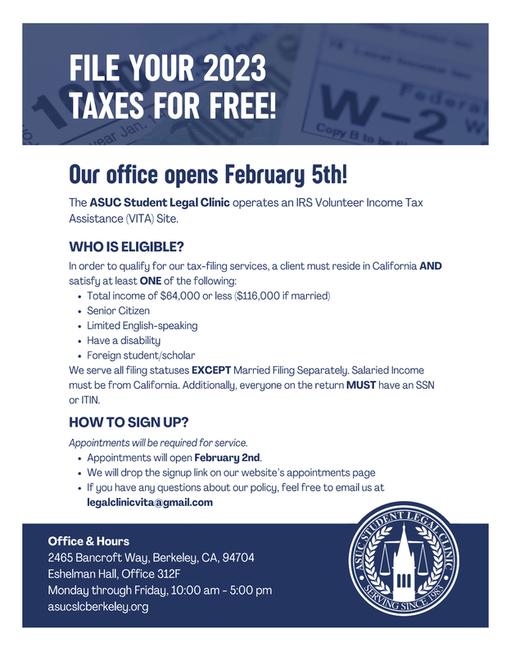

Tax assistance

Make appointments for free tax filing HERE.

For US Citizens, Permanent Residents, and Resident Aliens:

- Other free VITA tax prep sites: earnitkeepitsaveit.org

- IRS Free File: tinyurl.com/irsfreefile

- Berkeley Public Library: berkeleypubliclibrary.org/topics/personal-finance-tax

- Tax-Aid: tax-aid.org

- Paid tax prep services include H&R Block and Jackson Hewitt

- Other free VITA tax prep sites: earnitkeepitsaveit.org (select "Foreign Student Tax Returns" or "Apply for an ITIN" on the Category Dropdown)

- Glacier Tax Prep (provided through the University): online-tax.net

- Sprintax: sprintax.com

- H&R Block Expat Tax Services: hrblock.com/expat-tax-preparation

This IRS page further outlines how you can best prepare for your appointment with required forms and materials, and this IRS page outlines who is eligible for VITA.